Why More Homeowners Are Moving Despite Higher Interest Rates

Letting go of a 3% mortgage rate isn’t easy—there’s no denying that. It’s one of the biggest reasons many homeowners have held off on moving in recent years. But here’s something worth thinking about.

A great rate is nice to have, but it can’t fix the feeling of being cramped, the strain of climbing stairs every day, or the ache of being far from family. For many, those everyday needs are outweighing financial hesitation and prompting action.

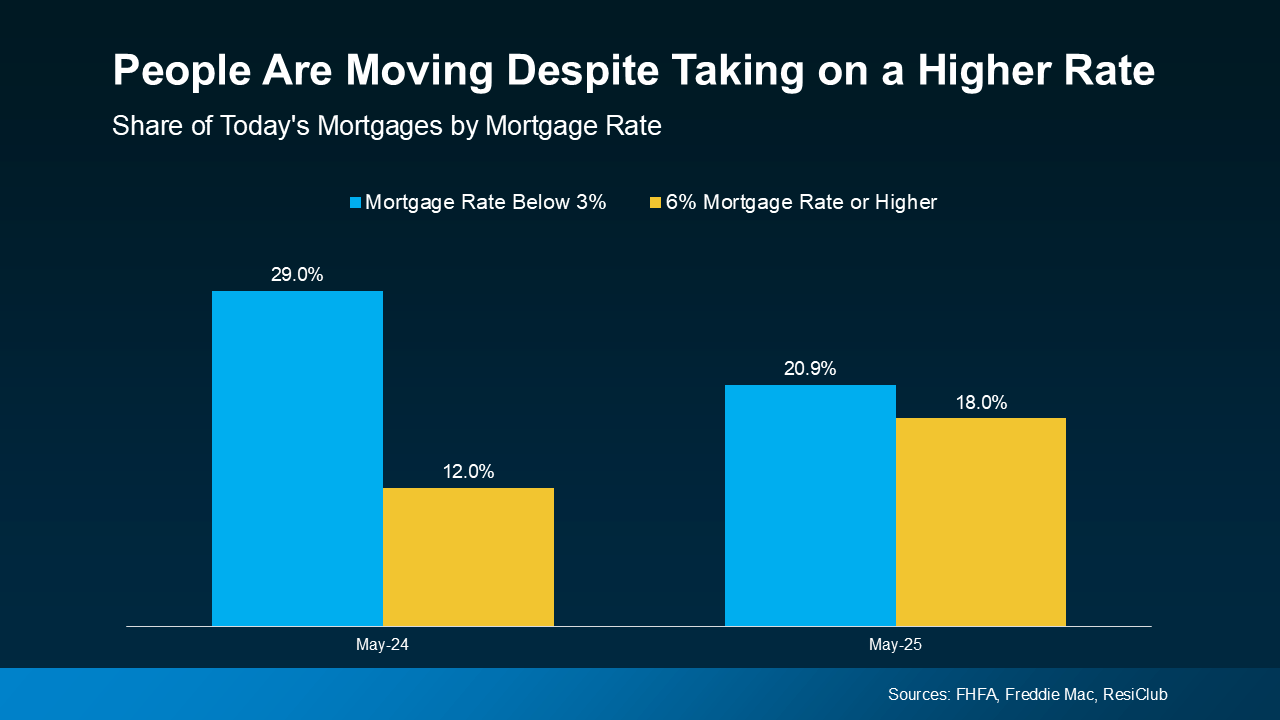

Recent data shows a decline in the number of homeowners holding mortgage rates below 3%, while the share of those accepting rates above 6% is steadily increasing.

What’s Driving Homeowners to Sell in Today’s Market

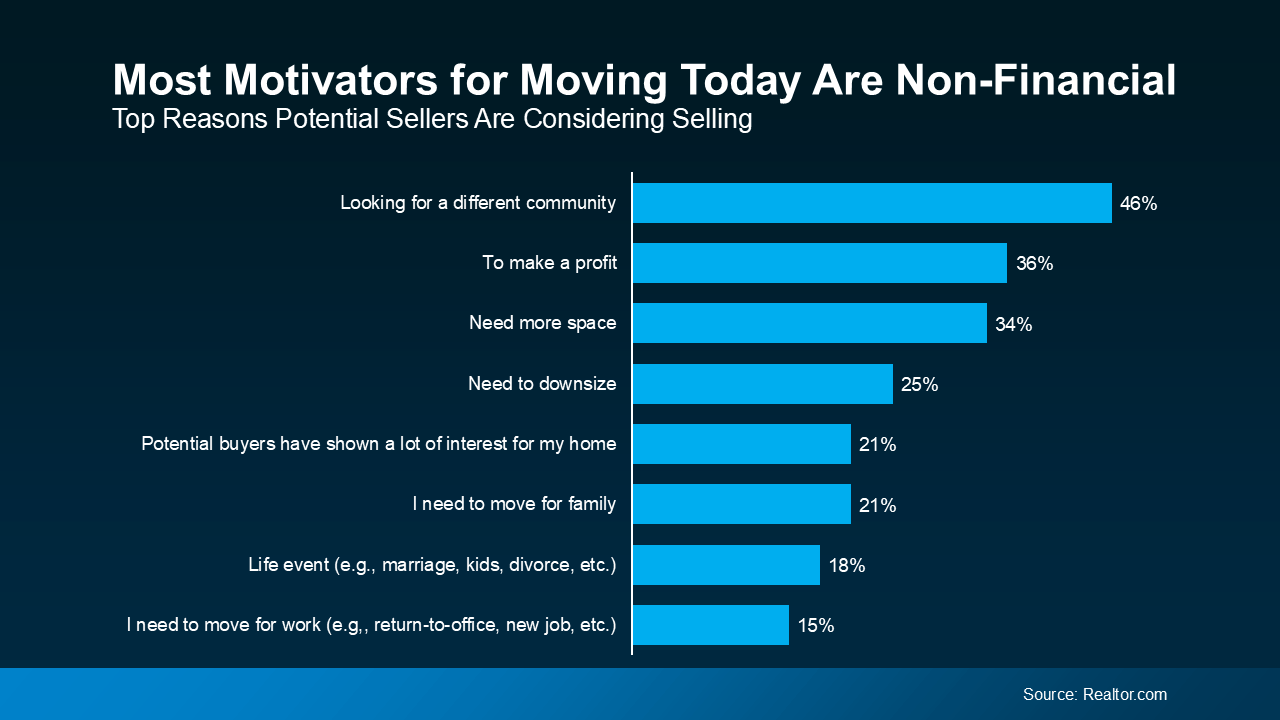

Why are some homeowners accepting higher mortgage rates? A recent survey from Realtor.com offers insight—79% of sellers today are moving out of necessity. And most of those reasons have little to do with finances (see graph below).

Are you experiencing something similar in your own life?

-

Needing More Space: Whether it’s welcoming a new baby, giving kids their own rooms, or making room for aging parents, outgrowing your current home can happen quickly.

-

Looking to Downsize: With the kids moved out, you might be ready for a simpler lifestyle—less upkeep, fewer rooms to manage, and lower utility costs.

-

Wanting to Be Closer to Family: Whether to assist with grandchildren or support elderly parents, the desire to be near loved ones often outweighs financial concerns.

-

Life Changes in Relationships: Divorce, separation, or blending households after a marriage or partnership can create the need for a fresh start in a new home.

-

Job-Related Moves: Whether you landed your dream job or your partner’s company is relocating, career changes often call for a move.

How Mortgage Rates Factor In

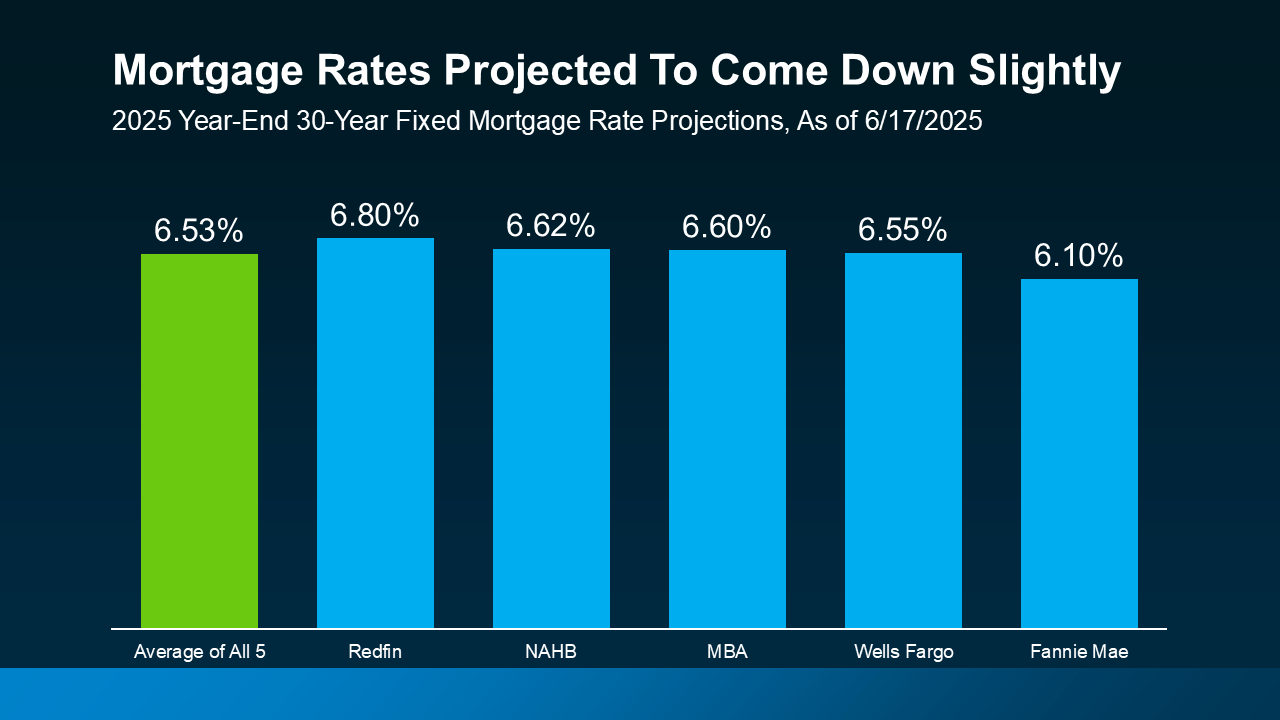

Experts anticipate mortgage rates will gradually decrease, but only modestly this year—not the significant drop to 3% that many hope for (see graph below).

While waiting for a significant drop in rates may seem like a smart strategy, it can also mean spending more time in a home that no longer meets your needs. For many, that waiting period has already lasted too long.

Realtor.com reports that nearly two-thirds of potential sellers have been considering a move for more than a year. If that sounds like you, it may be time to ask yourself:

How much longer are you willing to put your life on hold?

What It Comes Down To

Maybe your home suited your lifestyle five years ago. But the “for now” house you purchased in 2020 might not meet your needs today—and that’s completely normal.

Mortgage rates definitely play a role, but the more important question is:

What type of home best supports your life today?

Reach out to a Benson & Mangold agent to discuss how your needs have changed and explore the move that will best support your next chapter.