Why a Second Home Could Be the Key to Your Ideal Retirement

Are you on the path to a secure retirement?

Intuit reports that 69% of people feel today’s financial climate makes future planning difficult, and 68% are uncertain if retirement will ever be possible. As a result, many are seeking alternative strategies to create financial stability and long-term income.

This is where real estate becomes a valuable option.

The Power of Real Estate: What It Can Do for Your Future

If you can make it work financially, a second home could play a key role in your retirement strategy by helping you:

-

Build Long-Term Wealth: As property values appreciate over time, your second home can grow in value and contribute to your overall net worth.

-

Create an Income Stream: Renting out the property can provide additional income to supplement your retirement savings. Just keep in mind, a portion of that income will go toward the mortgage and upkeep of the home.

-

Unlock Future Profits: You might choose to sell the home later on, using the proceeds to give your retirement nest egg a significant boost.

-

Diversify Your Portfolio: Real estate adds a tangible asset to your financial mix, reducing reliance on stocks or savings accounts and adding more stability to your wealth strategy.

You Don’t Have to Be a Big-Time Investor to Own a Second Home

It’s a common misconception that owning multiple homes is only for big-time investors, but the numbers tell a different story. Many second-homeowners are everyday people—maybe even your neighbors.

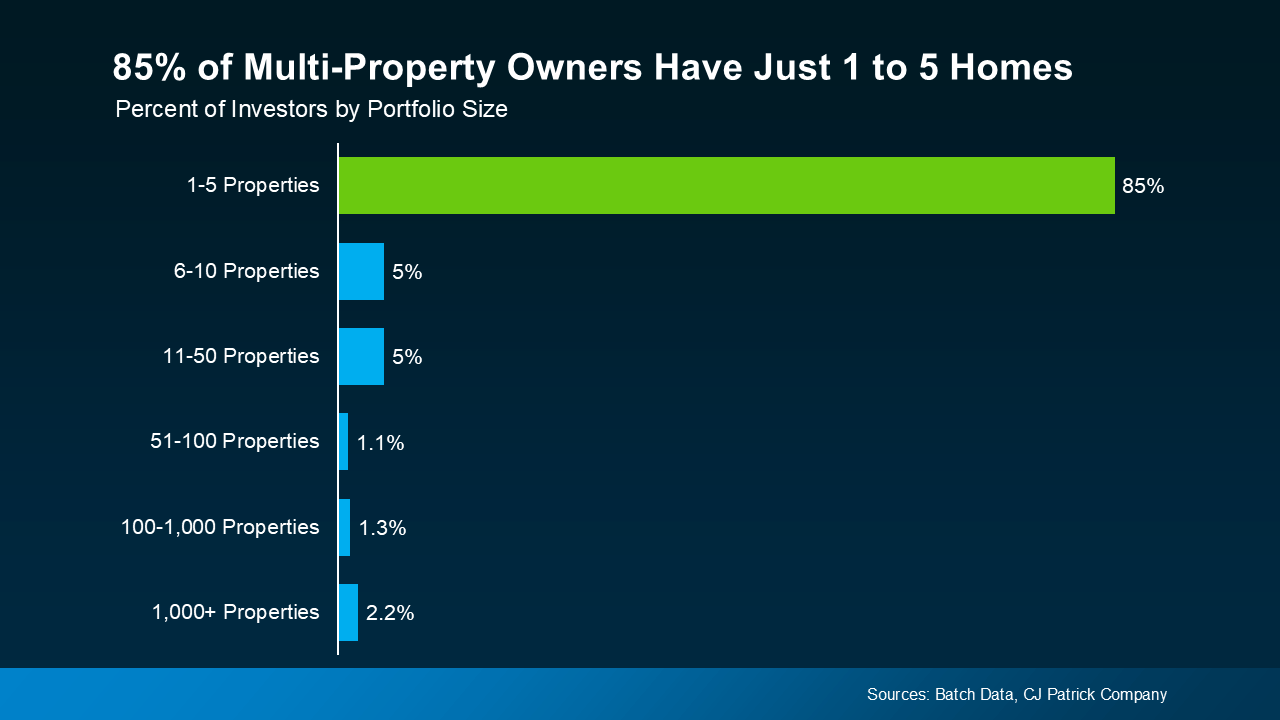

In fact, data from BatchData and CJ Patrick Company reveal that 85% of multiple-property owners possess between one and five homes (see graph below):

This means that most multi-home owners are everyday people—not large investors—who’ve purchased an extra property to rent out or keep for future use.

Why Now Could Be the Ideal Time

Currently, the door may be opening for buyers like yourself. As Danielle Hale, Chief Economist at Realtor.com, notes:

“. . . the balance of power in the housing market keeps shifting in favor of homebuyers. . . A confluence of factors—including more homes for sale, rising price cuts, and slower-moving inventory—is giving buyers more leverage than they've had in years . . .”

If you’re in a region where home values are projected to increase, purchasing a second property now and selling it later could boost your future finances. Alternatively, renting it out can provide you with immediate income.

Begin Your Journey with Trusted Professionals You Can Count On

If this idea piques your interest, the crucial first step is to reach out to a few trusted experts who can guide you through the process:

-

A Benson & Mangold agent with in-depth local market knowledge

-

A lender experienced in second home and investment property financing

Having the right professionals by your side empowers you to make confident decisions from the very start.

The Takeaway

Let’s explore the possibilities and see how owning a second home might offer you greater security and peace of mind for the future.

If owning a second home could help you retire sooner or enjoy greater freedom, would you be interested in learning more? Get in touch with one of our experienced agents to explore your options.