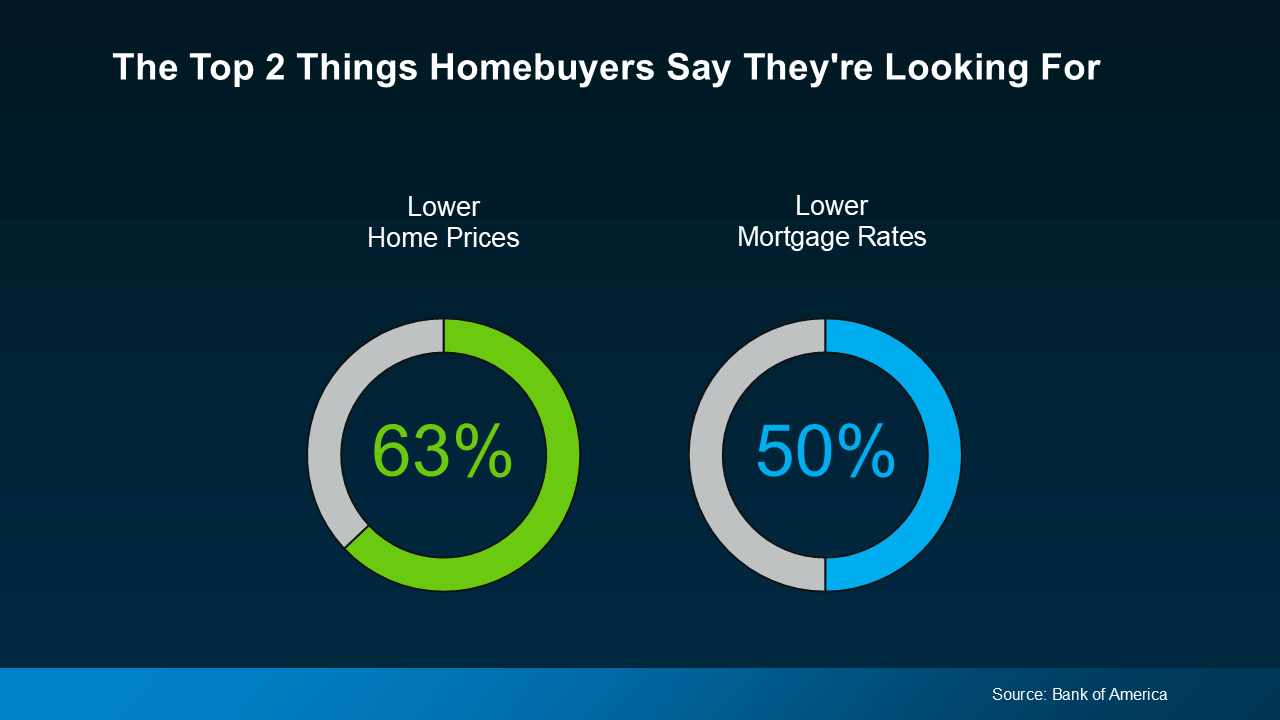

A recent Bank of America survey asked potential buyers what would make them feel more comfortable moving forward with a purchase. The results? No surprise here—affordability is the top priority, especially when it comes to home prices and mortgage rates.

The good news: while the economy as a whole still feels uncertain, the housing market is starting to show some encouraging changes. Here’s what you need to know.

Home Prices Are Cooling

Over the past few years, home prices rose quickly—sometimes at double-digit rates that left many buyers on the sidelines. But that pace has now slowed. For perspective, from 2020 to 2021, home values jumped nearly 20% in just one year. Today, experts expect increases in the single digits—a much healthier and more typical trend.

This doesn’t mean prices are falling, but rather that growth is moderating. For buyers, this shift makes budgeting and planning more manageable. Keep in mind, though, price trends vary by location: some markets are still rising while others may level off or see slight dips.

Mortgage Rates Are Easing

At the same time, mortgage rates have retreated from recent highs, easing some of the financial pressure on buyers. As Lisa Sturtevant, Chief Economist at Bright MLS, explains:

“Slower price growth coupled with a slight drop in mortgage rates will improve affordability and create a window for some buyers to get into the market.”

Even a small rate change can make a significant difference in monthly payments. While rates may fluctuate, forecasts suggest they’ll hold in the low-to-mid 6% range through the year ahead—much better than just a few months ago. If economic conditions shift, there’s even potential for further declines.

Why It Matters

Buyer confidence in the economy may still be low, but conditions in housing are gradually improving. With both prices and rates showing signs of moderation, affordability is becoming more achievable than it was earlier this year.

That doesn’t erase all challenges, but it does open new opportunities for buyers who may have hit pause before.

Bottom Line

The top two buyer concerns—prices and rates—are finally moving in a more favorable direction. As we head toward 2026, these trends could create new possibilities for homeownership.

If you’re considering a move, connect with a Benson & Mangold Agent. They can walk you through what’s happening in our local market—and what it means for your plans.