At Benson & Mangold Real Estate, we understand why renting can feel easier—no maintenance calls, no property taxes, and no long-term commitment. Just pay the monthly bill and move on. But there’s one major drawback: renting doesn’t build your financial future.

Homeownership does.

While renting offers short-term simplicity, it doesn’t contribute to your long-term wealth. Homeowners, on the other hand, grow their net worth simply by owning a home.

Renting vs. Owning: The Long-Term Difference

Here’s the core distinction: when you rent, your payment is gone the moment it’s made. When you own, a portion of every payment comes back to you in the form of equity—wealth that grows as you pay down your mortgage and as your home appreciates.

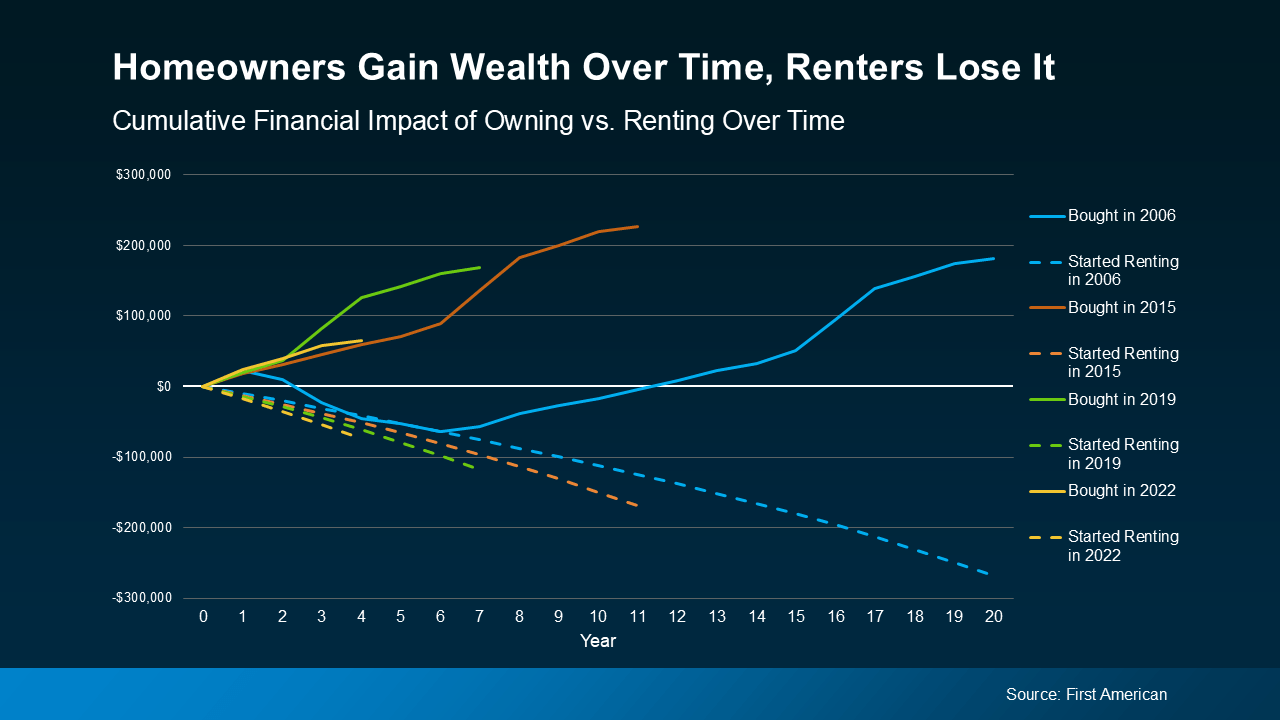

Research backs this up. A recent First American analysis compared the financial impact of renting versus owning across several key time periods, including:

-

2006: the height of the housing bubble

-

2015: ten years ago

-

2019: the last “normal” market before the pandemic

-

2022: when mortgage rates jumped

Across every scenario, the outcome was consistent:

Renters lost money over time. Homeowners gained it.

The study shows that regardless of market timing, homeowners steadily built wealth—even after factoring in costs like insurance, repairs, and property taxes. Renters, meanwhile, continued paying without receiving any long-term financial benefit.

The message is clear:

Time spent owning a home builds wealth. Time spent renting does not.

Affordability Is Beginning to Improve

It’s completely understandable if buying still feels out of reach. The past few years have been challenging for buyers. But we’re beginning to see a shift. Mortgage rates have eased, home prices are stabilizing, and incomes are rising. Zillow reports that typical monthly payments are slightly more manageable than they were this time last year.

Buying may not feel easy—but it is becoming more attainable. And historically, the long-term financial benefits make it well worth the effort.

Bottom Line

Renting may feel more affordable today, but owning a home is what builds real wealth over time. And with affordability starting to improve, the path to homeownership may be opening more than you realize.

If you’re curious about what buying could look like for you on Maryland’s Eastern Shore, the team at Benson & Mangold is here to help—pressure-free.