Student Debt Doesn’t Have to Delay Homeownership

A recent study found that 72% of people with student loan debt believe it will postpone their ability to buy a home. If you share this concern, you may be wondering:

- Should you postpone buying your first home until your student debt is cleared?

- Is home loan approval still within reach, even with existing student loans?

It’s completely normal to have questions like these, especially when considering such a significant investment. However, you may be delaying your homeownership goals more than necessary.

Does Student Loan Debt Prevent You from Qualifying for a Mortgage?

At its core, your main question is this: Can you still purchase your first home while carrying student debt? According to Yahoo Finance, here’s what you should know:

" . . . student loans don’t have to get in your way when it comes to becoming a homeowner. With the right approach and an understanding of how debt impacts your home-buying options, buying a house when you have student loans is possible."

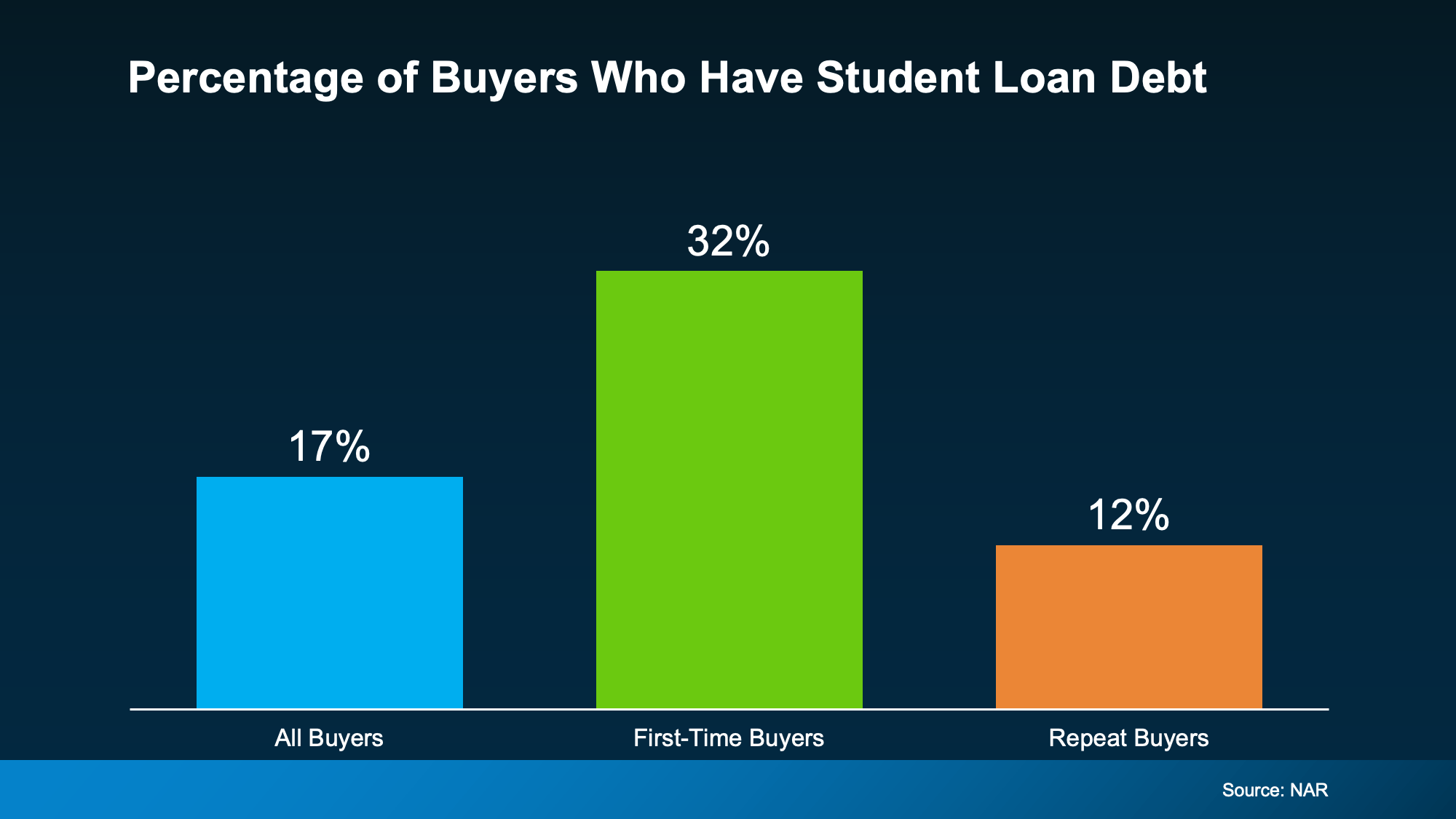

This is supported by data from the National Association of Realtors’ (NAR) annual report, which reveals that 32% of first-time buyers carried student loan debt (see graph below):

While each person’s circumstances are different, your goal of homeownership may be more attainable than you think. Many individuals with student loans have successfully qualified for and purchased homes. Let this reassure you that it remains possible, even for first-time buyers. For reference, the median student loan debt is $30,000. As noted in an article from Chase:

“It’s important to note that student loans usually don’t affect your ability to qualify for a mortgage any differently than other types of debt you have on your credit report, such as credit card debt and auto loans.”

With a stable income and sound financial standing, homeownership can remain attainable. Having student loans doesn’t automatically mean you need to delay purchasing a home.

What It Comes Down To

Having student loans doesn’t exclude you from the possibility of buying a home. Before ruling it out, consult with a lender to gain a clearer understanding of what you can afford and how near you are to beginning your homeownership journey.