At Benson & Mangold Real Estate, we’re starting to see encouraging signs for buyers across the Eastern Shore. After a few challenging years, homeownership is gradually becoming more attainable.

Monthly payments have begun to ease, and the affordability pressures buyers have faced are slowly starting to relax. While the market isn’t suddenly inexpensive, the improvement we’re seeing is meaningful—especially for those who have been waiting for the right time to make a move.

Affordability Is Moving in the Right Direction

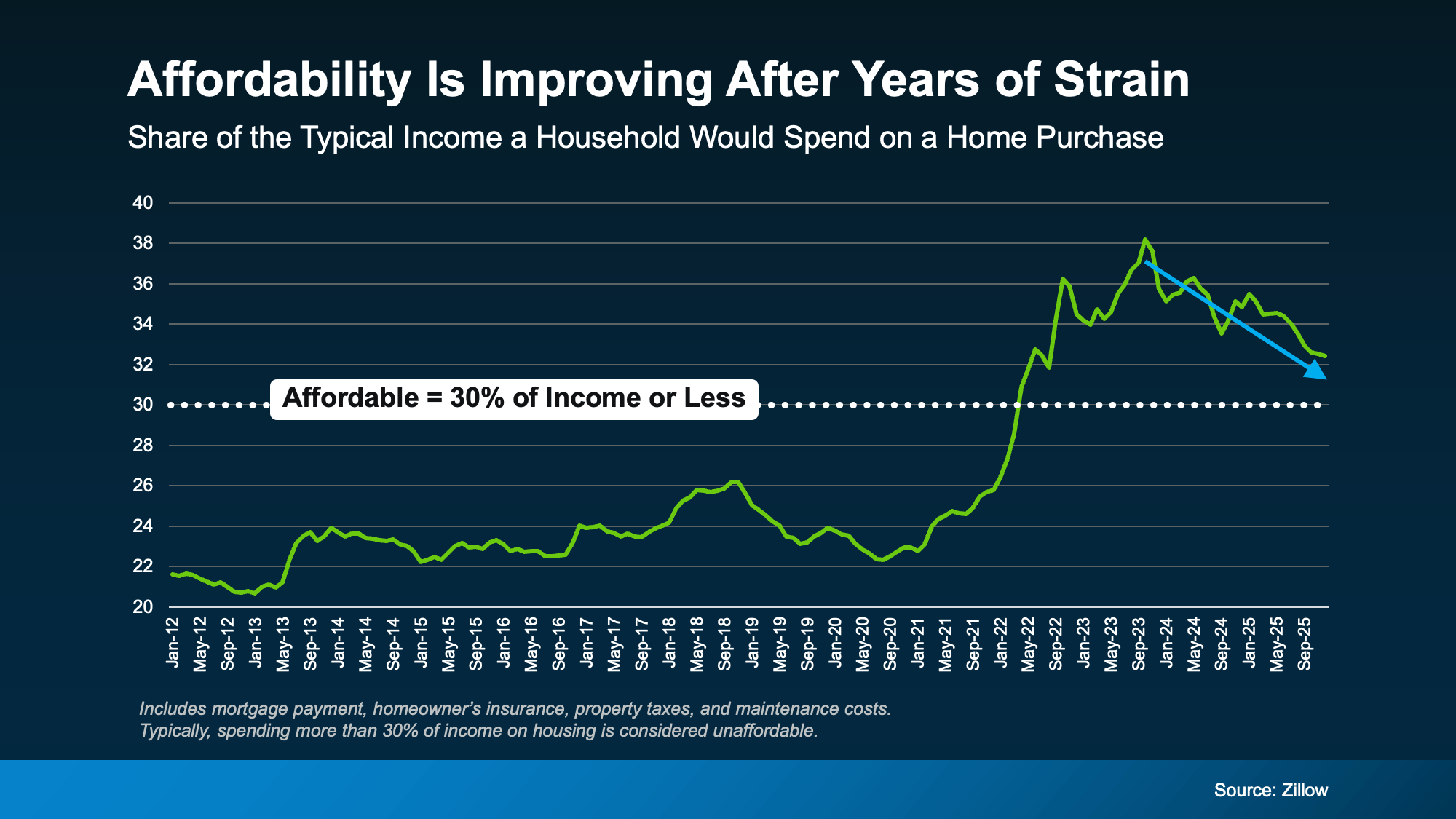

One of the clearest ways to measure affordability is by looking at how much of a household’s income is needed to cover the cost of homeownership.

Housing is typically considered affordable when it takes about 30% or less of a household’s monthly income to cover expenses such as the mortgage, taxes, insurance, and basic maintenance.

In recent years, that percentage climbed well above the traditional affordability threshold, making it difficult for many buyers to enter the market. Now, however, we’re beginning to see a shift back toward balance. While we’re not quite at that 30% benchmark yet, the trend is moving in a positive direction.

What’s Helping Buyers Right Now

Several key factors are working together to improve affordability:

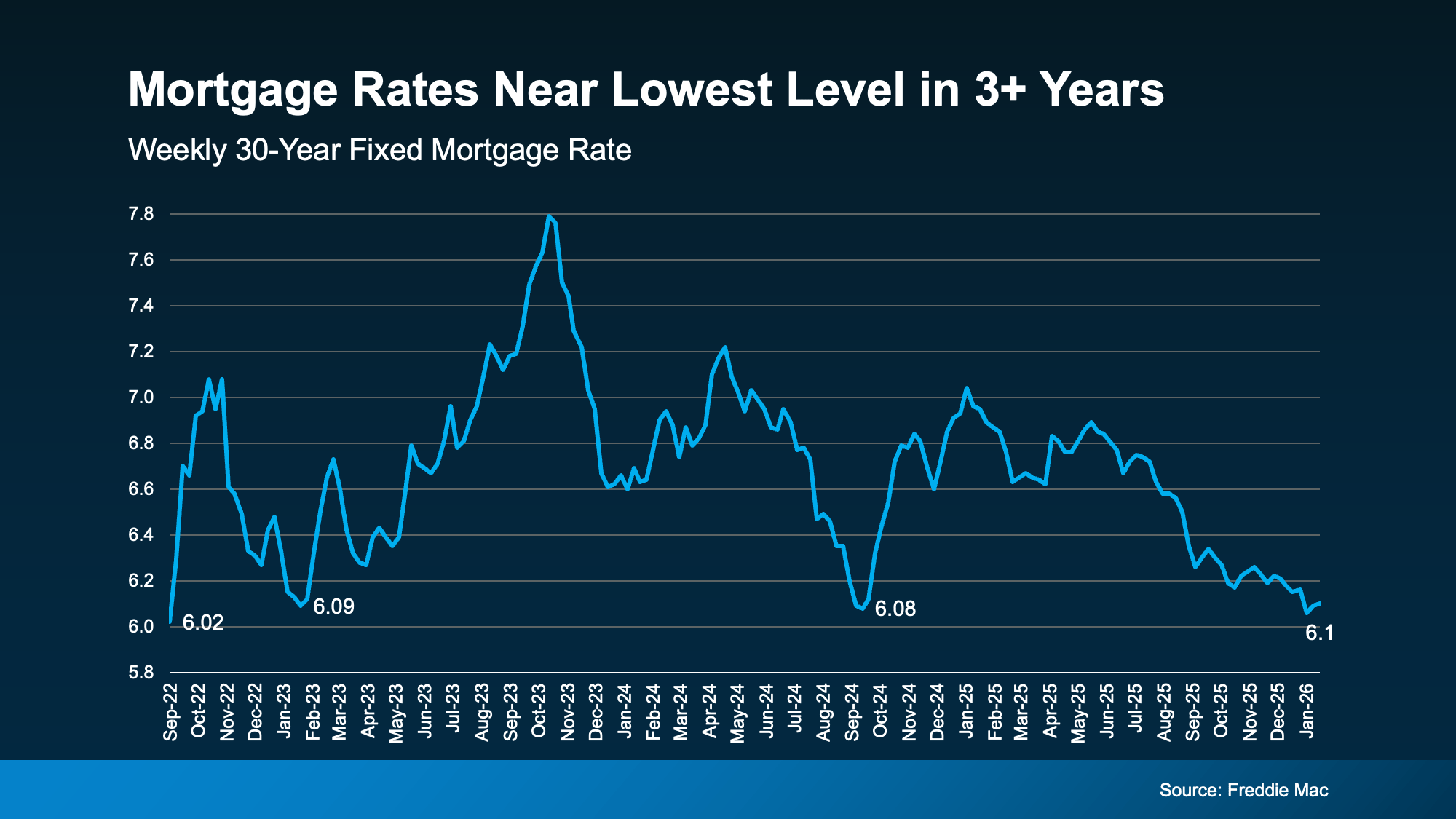

1. Mortgage rates have eased.

Rates have come down from recent highs, helping reduce monthly payments for many buyers.

2. Home price growth has slowed.

While prices are still rising in many markets, they’re increasing at a more moderate pace than they were a few years ago. This makes budgeting and planning for a purchase more predictable.

3. Wages are rising faster than home prices.

As incomes grow at a quicker rate than home values, overall buying power improves—even when interest rates remain elevated.

Together, these factors are beginning to shift the market in a more favorable direction for buyers. Affordability challenges haven’t disappeared, but the conditions that made the past few years especially difficult are starting to ease. Many economists expect this gradual improvement to continue through 2026.

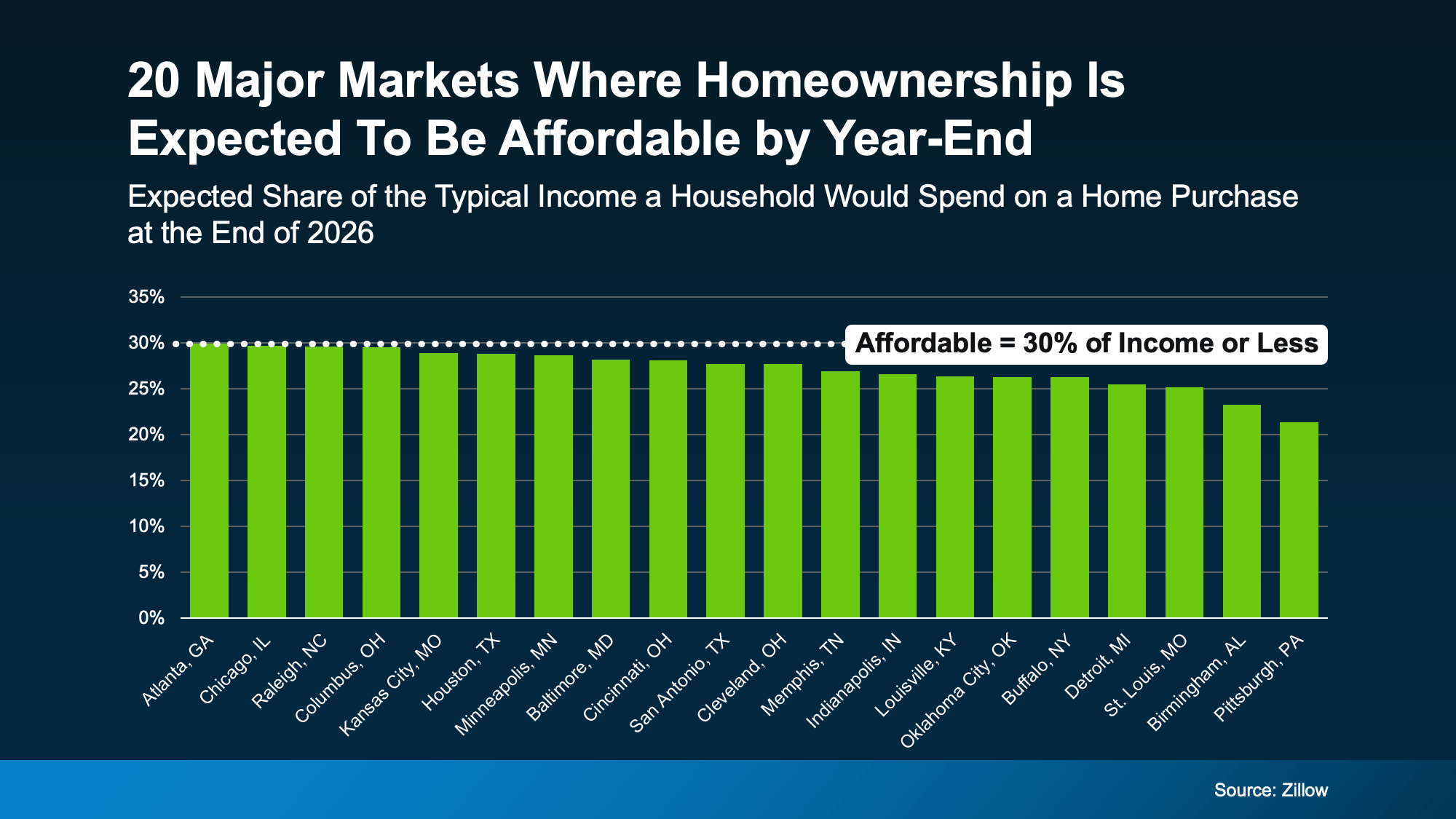

Local Markets Matter

Affordability isn’t improving at the same pace everywhere. Some markets are expected to return to more traditional affordability levels sooner than others, while some areas are already seeing meaningful improvements.

That’s why local insight is so important. What’s happening nationally doesn’t always reflect what’s happening here on the Eastern Shore. With the right guidance, you may find opportunities in today’s market that weren’t available just a year ago.

Bottom Line

For the first time in several years, housing affordability is moving in a more positive direction. It’s a gradual shift, but it’s an encouraging one for buyers.

If you’re wondering how these trends are affecting the market here on the Eastern Shore, the team at Benson & Mangold is here to help you navigate your options and find the right path forward.